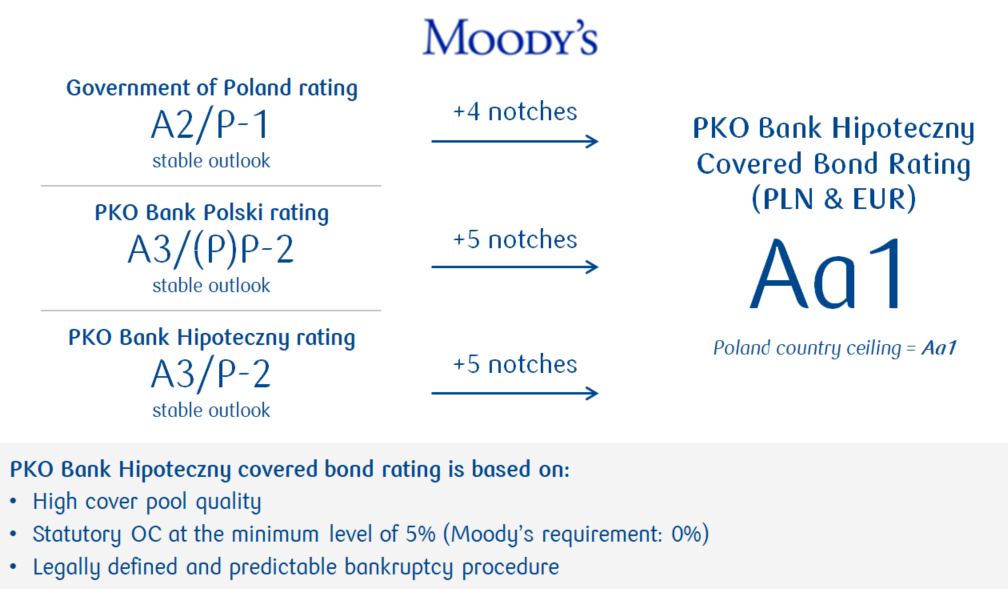

Ratings from Moody's Investors Service, commissioned by the Bank.

Type | Rating | Scale |

International covered bonds issuance programme rating | Aa1 | Ratings scale in descending order: Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, with the possible addition of numerical modifiers 1, 2 and 3 (with 1 being the highest) for ratings from Aa to Caa |

Domestic cover bonds issuance programme rating | Aa1 | Ratings scale in descending order: Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, with the possible addition of numerical modifiers 1, 2 and 3 (with 1 being the highest) for ratings from Aa to Caa |

Long-term counterparty risk assessment | A2(cr) | Scale in descending order: Aaa(cr), Aa(cr), A(cr), Baa(cr), Ba(cr), B(cr), Caa(cr), Ca(cr), C(cr) with the possible addition of numerical modifiers 1, 2 and 3 (with 1 being the highest) for ratings from Aa(cr) to Caa(cr) |

Short-term counterparty risk assessment | P-1(cr) | Scale in descending order: P-1(cr), P-2(cr), P-3(cr), NP(cr) |

Long-term counterparty risk rating | A2 | Ratings scale in descending order: Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C, with the possible addition of numerical modifiers 1, 2 and 3 (with 1 being the highest) for ratings from Aa to Caa |

Short-term counterparty risk rating | P-1 | Scale in descending order: P-1, P-2, P-3, NP |

Long-term issuer rating | A3 | Scale in descending order: Aaa, Aa, A, Baa, Ba, B, Caa, Ca, C with the possible addition of numerical modifiers 1, 2 and 3 (with 1 being the highest) for ratings from Aa to Caa |

Short-term issuer rating | P-2 | Scale in descending order: P-1, P-2, P-3, NP |

Outlook | Stable | Positive, stable, negative, developing |

Last update: 13 July 2021

Raitings were confirmed on 20th December 2022.

Detailed information on rating methodology and scale are available on the agency’s website.

- Moodys Press Release - completion of a periodic review of ratings of PKO BP

- Moodys Press Release - PKO BH long-term issuer ratings upgraded to A3

- Moodys Press Release - Upgrade the mortgage covered bonds issued by PKO Bank Hipoteczny S.A. to Aa1

- Moodys Credit Opinion PKO Bank Hipoteczny - 12 April 2022