Features of mortgage bonds and their security

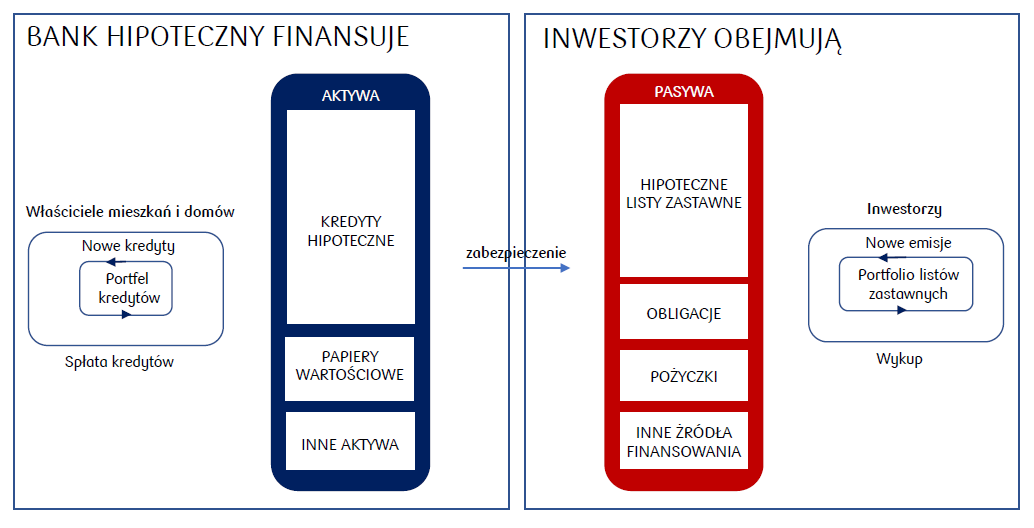

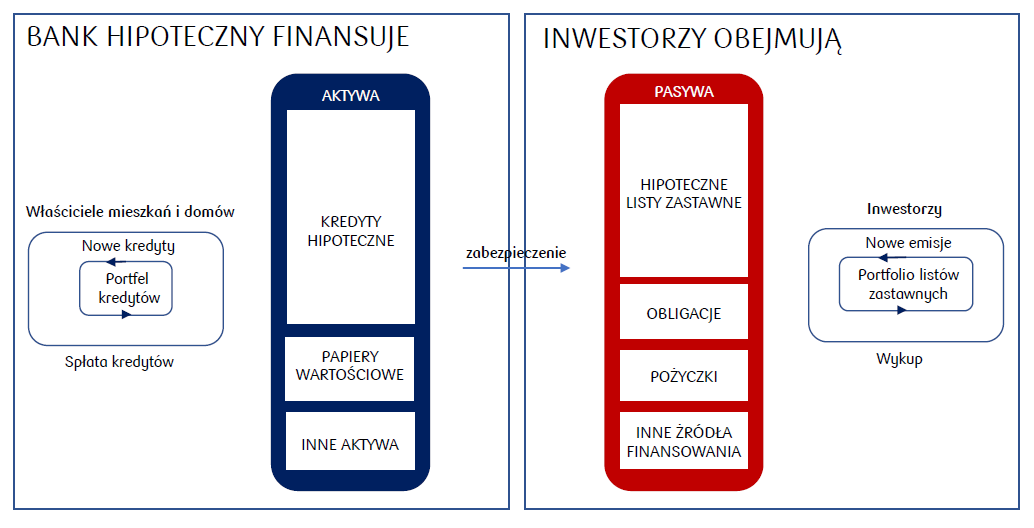

A mortgage covered bond is a debt security that is doubly secured: by a mortgage loan portfolio and by the mortgage bank's own assets.

- How does it work in practice?

- Borrower→ Takes out a mortgage and establishes collateral for the bank in the form of a first mortgage in the land and mortgage register.

- Mortgage bank→ Keeps a register of legally established collateral and issues mortgage bonds based on its value.

- Capital market→ The bonds issued by the mortgage bank are purchased by investors and listed on the Warsaw Stock Exchange.

- Investor→ Receives interest and capital repayment (on the dates specified in the terms and conditions of issue) and may also sell the bond before maturity on the market (i.e. before the date specified in the terms and conditions of issue for the redemption of the bonds by the mortgage bank).

In Poland, mortgage banks most often issue bonds based on variable interest rates.The mortgage bond is secured by the mortgage bank's receivables from loans granted. Mortgage bonds are issued by PKO Bank Hipoteczny in PLN or in foreign currencies.

- Safety of cover bonds

Covered bonds are characterised by their high level of safety and low investment risk, primarily because the loans that are the basis for issues of covered bonds are properly secured.

This issue is regulated by the Act on Covered Bonds and Mortgage Banks dated 29 August 1997 (unified text: Journal of Laws Dz. U. 2022, item 581 with amendments):- mortgage banks apply long-term property valuation that take into account potential movements in the prices of the property during the loan period (the mortgage lending value);

- loans secured by mortgages over real property under construction cannot exceed 10% of the aggregate principal amount of loans which are the basis for a covered bond issue. Loans secured with mortgages over real property which has not been built on cannot exceed 10% of this limit.

The safety of covered bonds is further increased by the degree of specialisation of mortgage banks’ operations, which limits the risk that the issuer will become insolvent.

The safety of covered bonds also derives from the legal regulations concerning issuance:

- the mortgage bank’s refinancing of loans using the proceeds of covered bond issues cannot exceed, in relation to a given loan or receivable, 60% of the mortgage-lending value of the property, and in the case of residential property within the understanding of art. 4 para. 1 point 75 of Regulation (EU) No. 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms – 80% of the mortgage-lending value of the secured property;

- the total nominal value of a mortgage bank’s outstanding covered bonds cannot exceed 40 times its own funds;

- the total nominal value of mortgage receivables and other rights and means in the cover pool for an issue of mortgage covered bonds cannot be lower than 105% of the total nominal value of outstanding mortgage covered bonds (while the nominal value of the bank’s receivables secured by mortgages and constituting the basis for an issue of mortgage covered bonds cannot be less than 85% of the total nominal value of outstanding covered mortgage bonds);

- the mortgage bank’s interest income from receivables secured by mortgages, or receivables that constitute the basis for an issue of public covered bonds, and the mortgage bank’s other rights and means that form the basis for an issue of mortgage covered bonds or public covered bonds, is determined separately for mortgage covered bonds and public covered bonds, and cannot be lower than the interest costs of the respective type of bond already in circulation;

- the mortgage bank is obliged to maintain, separately for mortgage covered bonds and public covered bonds, a liquidity buffer of at least the maximum cumulative net liquidity outflow (i.e. outflows of payments due on a given payment date, including payments of the nominal value of covered bonds and interest on those bonds and payments on derivatives under the covered bond programme, after deduction of the proceeds of payments due on the same date on the assets securing the cover of covered bonds) in the following 180 days; the funds designated for this liquidity buffer cannot form the basis for an issue of covered bonds;

- if covered bonds are issued in a different currency than the mortgage bank’s receivables or funds, the mortgage bank is obliged to hedge its foreign-currency risk.

- Our ratings by Moody's Investors Service

The high level of safety of PKO Bank Hipoteczny’s covered bonds is confirmed by their Aa1 rating from Moody’s.

- Register of collateral for covered bonds

See monthly reports on the PKO Bank Hipoteczny collateral register

- The mortgage bank maintains and stores a register of collateral for covered bonds, in which the mortgage bank's receivables and the rights and funds constituting the basis for the issue of covered bonds are entered in separate items, as well as funds constituting a surplus of not less than the total nominal value of interest on mortgage or public covered bonds in circulation, payable within the next 6 months.

The manner of keeping the collateral register is specified by:

- The Act of 29 August 1997 on covered bonds and mortgage banks

- Recommendation K of the Polish Financial Supervision Authority of February 2016 on the rules for keeping the covered bond collateral register by mortgage banks

- Ongoing supervision of the maintenance of the mortgage bond collateral register is exercised by the Trustees.

- Trustees at PKO Mortgage Bank

Mortgage banks create a portfolio of receivables entered in the mortgage bond security register. Investors have priority over the assets entered in the register. The value of the collateral in the register must be higher than the value of the mortgage bonds issued. The quality of the register is examined by trustees appointed by the Financial Supervision Authority.

Domestic Covered Bond Programme

International Covered Bond Programme

Cover pool reports

- Reports 2025

- Reports 2024

- Reports 2023

- Reports 2022

- Reports 2021

- Reports 2020

- Reports 2019

- Reports 2018

- Reports 2017

- Reports 2016